The Autumn Budget 2025 & What It Could Mean For You.

Posted: Insights News Resources

Posted: Resources

Start the new year with a 12-month tax plan that aligns with your growth goals.

How to guide:

Your ambition deserves a strategy, not tax-time panic.

Plan your tax to grow your business, not just pay the bill.

Ready to build smarter this year? Let’s plan your growth from the ground up. For more information contact the team on info@burgesshodgson.co.uk

Review your business structure (Ltd, LLP, holding company) to ensure it still supports your goals.

We understand that growing businesses outgrow their structure fast. Book your free 20-minute structure review now. For more information contact the team on info@burgesshodgson.co.uk

Use tax-efficient timing for dividends, bonuses, and major purchases.

Timing of dividends, bonuses and expenditure

Effective tax planning is not just about how much you pay, but when you pay it. The timing of dividends, bonuses and major expenditure can significantly affect corporation tax, personal tax and cash flow.

1. Timing of dividends and bonuses

Corporation tax considerations

Paying bonuses within 9 months of the accounting period end can therefore lower the company’s corporation tax bill for that year.

Income tax implications

The tax impact depends on which tax years the income falls into and the individual’s total income level.

Timing strategies

Dividend and bonus timing checklist

2. Timing of major purchases and capital allowances

Capital allowances provide tax relief on qualifying capital expenditure by reducing taxable profits.

Common Capital Allowances

Qualifying assets commonly include plant, machinery, equipment and certain fixtures.

Timing Strategies

Capital Allowance Checklist

3. Integrating tax timing with cash flow

Tax efficiency must support, not undermine, financial stability.

Best Practice

4. Common pitfalls to avoid

Regular reviews with your tax advisor help ensure strategies remain effective and compliant.

Final thoughts

Well-timed dividends, bonuses and capital expenditure can significantly reduce tax liabilities while supporting healthy cash flow. With forward planning and professional advice, UK businesses can stay compliant, efficient and financially resilient.

Next step to financial freedom: book your strategy session today

Your business is unique, and so are your Tax opportunities

Contact us at info@burgesshodgson.co.uk to schedule your Tax timing and cash flow review today.

R&D Tax relief eligibility checklist

Many businesses leave thousands of pounds on the table each year by overlooking valuable tax reliefs.

Use this quick checklist to see whether your business may be eligible for R&D tax relief. If you answer YES to all the questions below, it’s well worth getting expert support to explore a claim.

Your R&D Tax relief self-check:

HMRC notification

☐ Has your company pre-notified HMRC of your intention to make an R&D claim?

(Required if this is your first claim or you haven’t claimed in the last three accounting periods, this must be done within 6 months of your period end.)

Project activity

☐ Did your company undertake a project during the period conducted to a method or plan?

Scientific or Technological baseline

☐ Is there a clearly established baseline in knowledge or capability at the start of the project within field(s) of science or technology?

Technological advance

☐ Can you clearly explain the advance you are trying to achieve beyond that existing baseline?

☐ Are you seeking to extend knowledge, establish new capabilities, make appreciable improvements to what already exists or build something with the same performance characteristics but in a fundamentally different way?

Technical uncertainty

☐ Can you identify the scientific or technological uncertainties that need to be overcome to make that advance?

Problem-solving activity

☐ Can your business evidence the work carried out during the period to attempt to resolve these uncertainties?

☐ Were the methods or solutions attempted beyond what would be readily deducible by competent professionals in the field?

Expertise

☐ Do the people leading or managing the project possess relevant experience and technical qualifications to demonstrate they were suitably skilled to define and attempt those advancements?

What does your score mean?

YES to ALL questions?

Your company may be eligible for R&D tax relief.

Next step: Speak to our tax relief specialists to confirm eligibility and ensure your claim is:

SOME NO answers?

You may still qualify, but the scope and structure of your claim may need expert guidance.

Get advice to avoid missing out on relief that could fund your next phase of growth.

Contact our team for a confidential eligibility review at info@burgesshodgson.co.uk

Make use of the annual allowances that reset every tax year (dividends, CGT, pensions, ISA).

5 allowances every business owner should use.

Book an annual allowance audit with our specialist team today. Contant us at info@burgesshodgson.co.uk

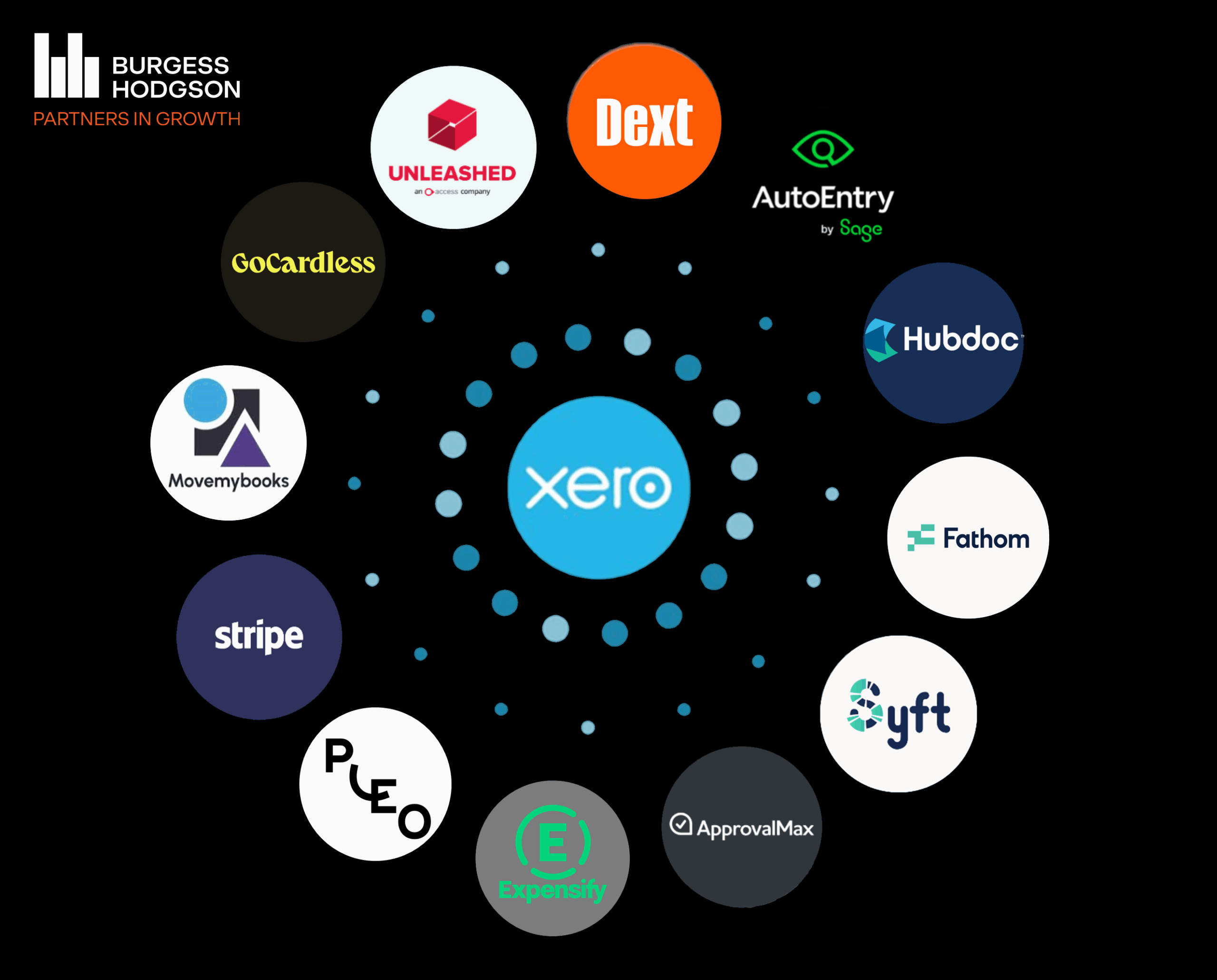

Bring your finance systems together (accounting + payroll + expenses) for easier business reporting.

Discover the best way to avoid the administrative drag. Contant us at info@burgesshodgson.co.uk

Founders often miss SEIS/EIS opportunities for raising investment tax-efficiently.

EIS and SEIS Cheat Sheet

A growth-focused tax strategy for business owners

What are SEIS and EIS?

SEIS (Seed Enterprise Investment Scheme) and EIS (Enterprise Investment Scheme) are UK Government incentives designed to help ambitious businesses raise finance by offering powerful tax reliefs to private investors.

Both schemes make investing in your business far more attractive by reducing investor risk. Enabling you to raise money faster and more easily and enabling higher early-stage valuations.

The essential step: HMRC Advance Assurance

Before raising money under SEIS or EIS, you should apply for Advance Assurance from HMRC. This assurance acts as confirmation that your company qualifies for SEIS/EIS.

Best practice is to seek new Advance Assurance for each major funding round, even though approvals are not time limited.

To submit a successful application, HMRC will require:

Company details

Business status

Trading activity

Business plan/Investment deck

3-year financial forecast

Potential investor details

How we can help

Our experts specialise in guiding business owners through the SEIS/EIS process:

Ensuring approval is secured efficiently and aligned to your growth strategy.

Growth strategy tip

SEIS and EIS aren’t just tax relief schemes; they’re powerful fundraising accelerators when structured correctly:

For more information on how the team can help your business, contact us on info@burgesshodgson.co.uk

Make sure you’re claiming the legitimate business expenses founders often overlook.

Our “often-overlooked” Expenses list

Take a moment to review your expenses and check you’re not leaving money on the table

Tax risk increases as you grow – review VAT, IR35, PAYE, and cross-border activity.

Book a Tax Risk Review with us today.

Combine business and personal tax planning; especially pensions and exit strategy.

Article: How business owners protect their future.

Protecting your future: turning business value into personal wealth

For many business owners, the business is their most valuable asset. Considerable time and effort are spent growing turnover, profitability, and valuation. Yet a strong valuation alone does not guarantee long-term personal financial security.

The real challenge is ensuring that business value is converted into personal wealth in a structured and tax-efficient way, while still protecting future growth and sale potential. This requires business and personal tax planning to be treated as a single, joined-up strategy, particularly when considering pensions and exit planning.

Business value and personal wealth are not the same

A growing valuation represents potential rather than certainty. Until profits are extracted or an exit is achieved, that value remains exposed to commercial risk, market conditions, and tax change.

Business owners who rely entirely on a future sale to fund long-term goals often place unnecessary pressure on that outcome. A more resilient approach is to build personal wealth alongside business growth, reducing dependency on any one future event.

Ten tax efficiencies business owners should be aware of

When planning is coordinated, business owners may benefit from several tax efficiencies that help protect both valuation and personal wealth:

Each of these is most effective when considered as part of a wider long-term strategy rather than in isolation.

Once funds have been extracted from the business, consider the tax efficient methods of growing value, such as ISA’s, EIS, VCT. This should only be considered with additional advice from your financial advisor from an investment and risk perspective.

Exit strategy: converting value into wealth

Planning ahead allows business decisions made today to support future value realisation, rather than unintentionally restricting options. Exit strategy should be seen as an ongoing process, reviewed as the business and personal objectives evolve.

A final thought

A successful business is a powerful wealth generator, but only if its value can be realised efficiently.

By combining business and personal tax planning, particularly around pensions and exit strategy, business owners move from simply building value to protecting and retaining it.

Despite ever changing legislation, one message remains consistent; those who plan early keep more of what they build and retain greater control over their future.

Speak to our team about building a joined-up tax and wealth strategy on 01227 454 627 or contact us at info@burgesshodgson.co.uk

Revisit reliefs that might now apply due to growth or new activity (e.g. BADR, group relief, capital allowances).

Check out our poll on social media to vote on: “Which relief are you unsure about?”

Stay tuned for our follow up post!

If your business has grown, diversified, or changed direction in the last few years, it may be time to review which reliefs now apply. A short, forward-looking tax review can provide clarity and unlock value. Contact us today at info@burgesshodgson.co.uk

Build a business owner friendly 2026/27 tax roadmap that adapts as your business grows. Tax shouldn’t be reactive, ambition needs planning.

Book your pre-year-end review and plan for the year ahead. Contact us today at info@burgesshodgson.co.uk